does betterment provide tax documents

Does Betterment have in. While we strive to provide a wide range offers Bankrate does not include information about every financial or credit product or service.

Your 2015 Tax Season Calendar Tax Season Season Calendar Tax Help

Its a B khata property.

. A rundown of tax documents youll need to file your tax return. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a clients financial situation and do not incorporate specific investments that clients hold elsewhere. Join today from as little as 5 a month.

I share the money tips tricks and strategies I use to manage our finances invest wisely use credit responsibly and get the most from our money. 00401 Nebraska adjusted gross income for a partial-year resident individual is all income not taxed by another state which is earned while a resident and all income derived from Nebraska sources according to Reg-22-003 while a nonresident after the adjustments provided in Reg-22-00403. Education Credit.

I was under the impression that I only had to keep tax related documents going back 7 years. Like I have no problem seeing the 40 year trends of whats been happening with stock markets and over time see a surplus. Seller paid tax till 2018-19 as land.

If you are a Member you also benefit from instant access to all content free documents and our landlords helpline available 7 days a week. Article 1 - The Legislative Branch Section 8 - Powers of Congress. Can you please provide contact for khata Transfer and property tax.

Filing Taxes on an FBO Trust. Thank you for this list. Know what tax documents youll need upfront Get started.

For many investors the tax filing deadline is enough to induce a headache but it doesnt have to be that way especially since there is plenty of tax software to. PeopleImagesGetty Images You can file. While we strive to provide a wide.

If youre in a rush its best to prepare for the application process by pulling out all the documents you need ahead of time. It does not give personalized tax investment legal or other business and professional advice. Its that time again like a bad penny Tax Day keeps turning up year after year.

The general procedure is to fill out and attach IRS Form 1041 and its associated schedules with your own federal income tax return IRS Form 1040You will probably need IRS Form 4797 for capital gains and losses and IRS Form 4952 for interest. The above article is intended to provide generalized financial information designed to educate a broad segment of the public. Opening a bank account usually doesnt take that long especially if you apply online.

I guess I will have to make a point of keeping those documents permanently. The Congress shall have Power To lay and collect Taxes Duties Imposts and Excises to pay the Debts and provide for the common Defence and general Welfare of the United States. I asked my local broker to do a transfer in kind to.

The documents include- Title Deed property assessment extract property PID number city survey sketch from the Department of Survey and Settlement and Land Records up-to-date tax paid receipt earlier sanctioned plans if any property drawings 2 copies of demand drafts foundation certificate if any and a land use certificate issued by the competent. One of the best-known is TurboTax but there are plenty of alternatives. Article 1 Section 8 of the United States Constitution.

Recently BBMP officers came for property tax. Filing taxes on an FBO Trust is best left to a tax accountant or financial advisor. Join us as we figure this out together.

My scares come from not knowing how to manage these Vanguard funds. REG-22-004 Income of Partial-Year Resident Individuals Subject to Nebraska Income Tax. Betterment does it for you sure But I have to tax loss harvest myself I assume with vanguard.

Youll also want to keep the receipt for any item that has a warranty until the warranty expires. I still need to transfer khata from my seller to my name. But all Duties Imposts and Excises.

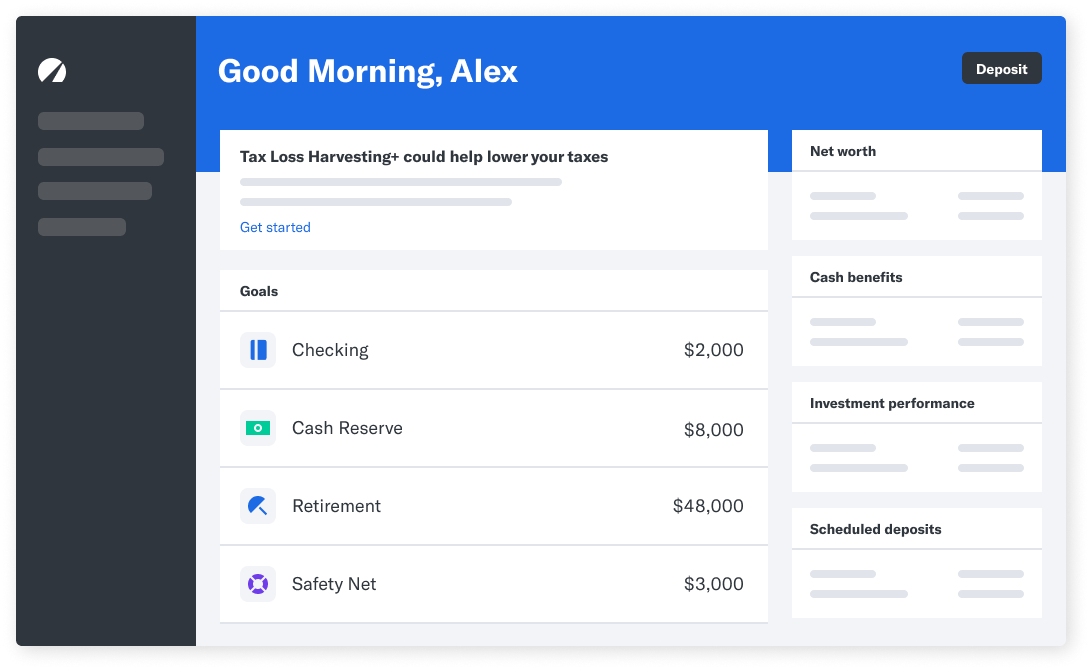

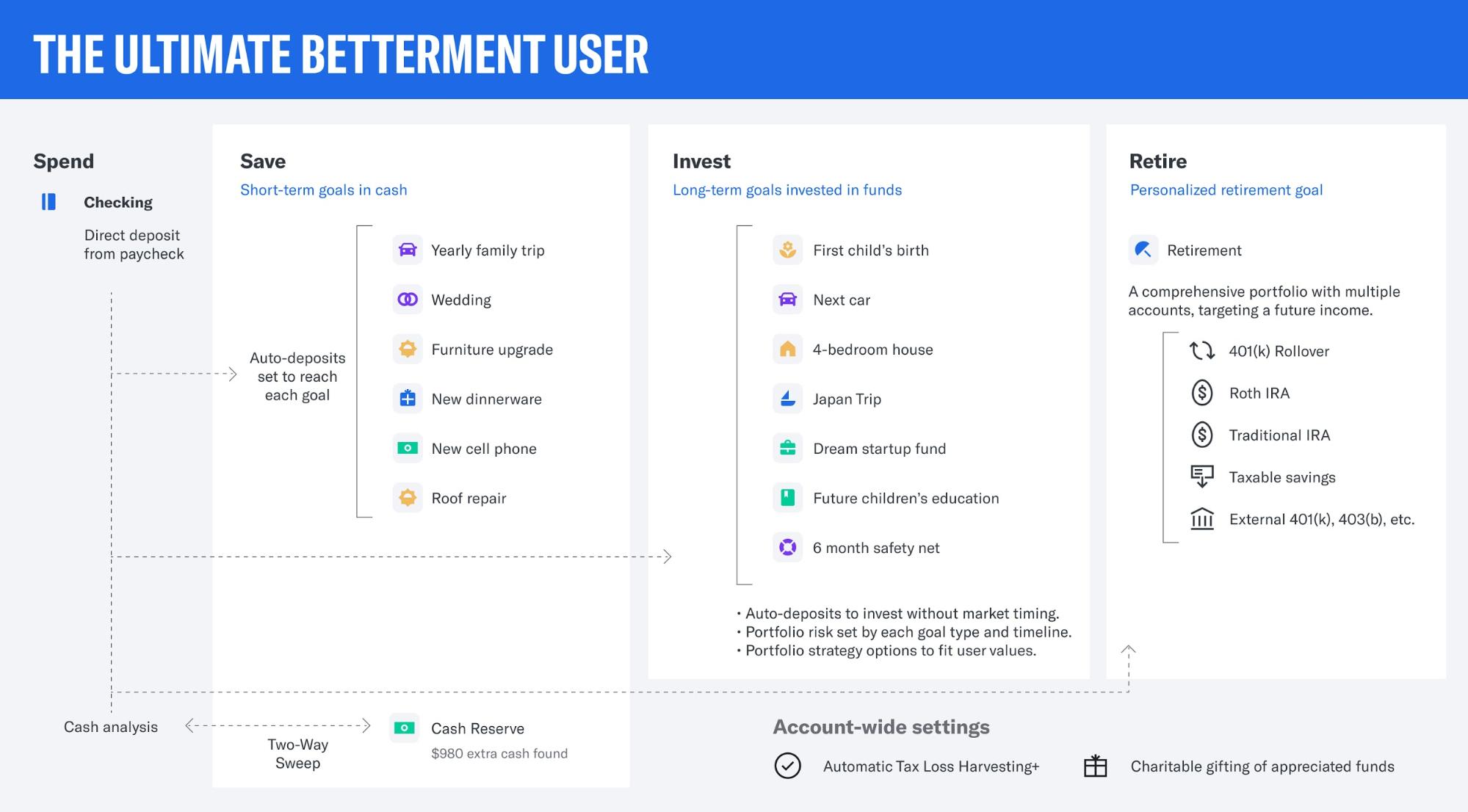

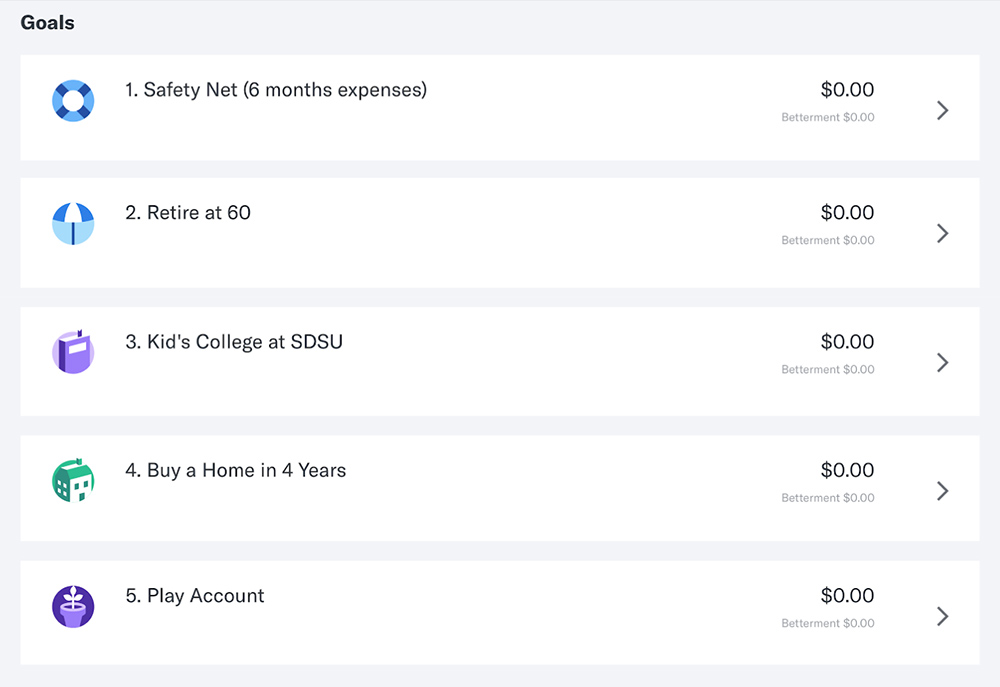

Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals. Im super okay with that. Betterment uses AI to provide personalized digital investment.

There are many programs designed to help people prepare and file their taxes. Perfect for your piece of mind. Filling out an application may take minutes and receiving all the documents you need could take up to 10 business days.

Im ready to pay tax as pg building but they are asking hefty commission from me.

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

The Gst Consultant In Gurugram Who Offer The Services With Betterment In Compliance With Other Firms We Offe Chartered Accountant Audit Services Income Tax

6 Tax Strategies That Will Have You Planning Ahead

How To Set Up Your Investments Correctly At Betterment

How To Start Investing With Betterment Investing Start Investing Robo Advisors

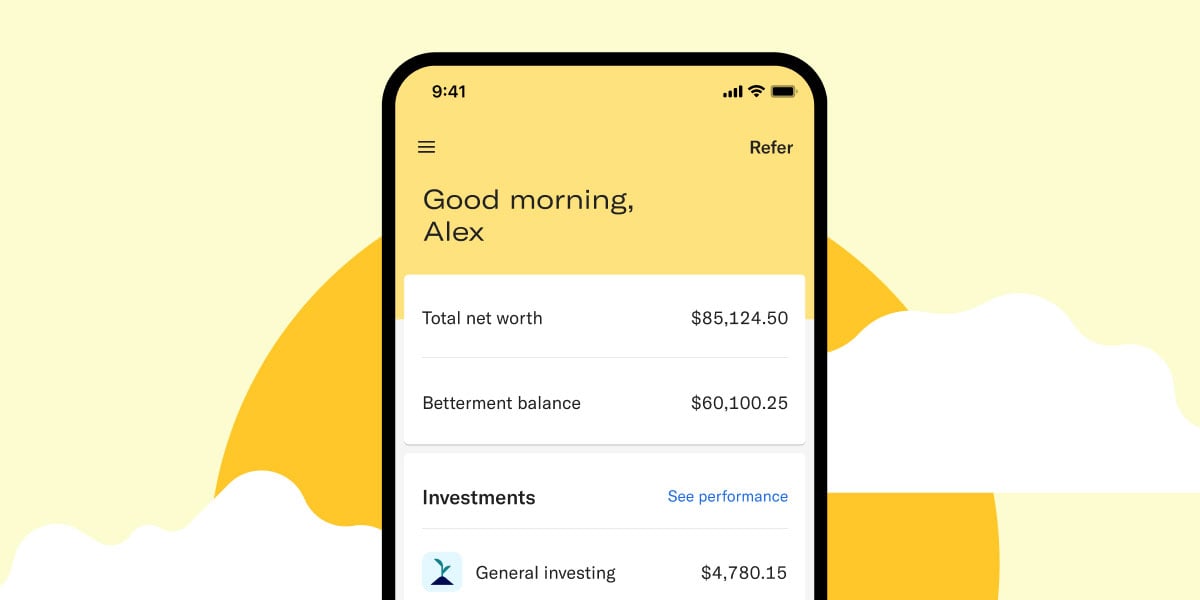

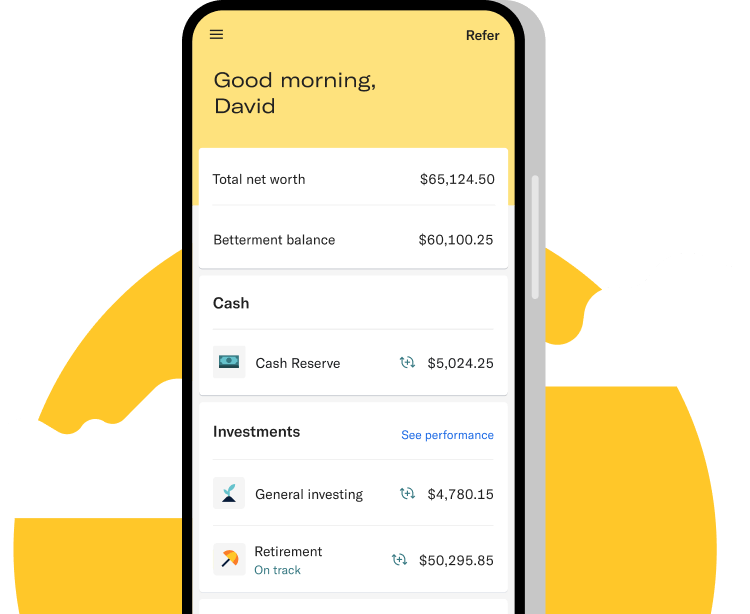

Betterment Mobile App Investing On The Go